Developing Your Financial Plan

The process of creating your comprehensive financial plan is simple. It involves the translation of your personal goals and objectives, such as buying a house, saving for your children's education, and saving for retirement, into specific strategies and finally actions.

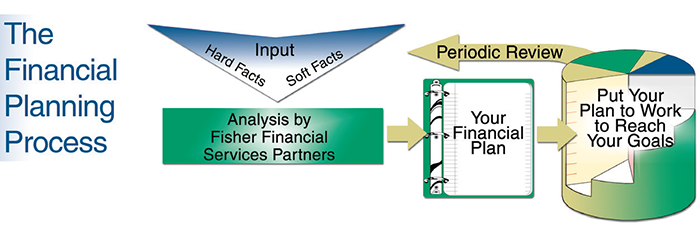

The Financial Planning Process

Gather Data:

First we gather information relating to your financial situation. The information includes "Hard" facts, such as statements from bank accounts, investment accounts, and retirement accounts as well as insurance policies, pay stubs, income tax returns, and employee benefits booklets.

Identify Goals and Objectives:

Next we listen as you describe the strengths and weaknesses of your current situation and articulate your financial and personal goals and objectives. Here we gather the "Soft" facts that allow us to personalize your financial plan by focusing on relational and quality of life issues.

Plan Development:

We will identify, explain, and recommend financial products and service providers that will become the building blocks of a comprehensive financial plan designed with a goal to help meet your financial and personal goals and objectives.

Implementation:

The best plans and solutions can never be effective without taking action. We will stay with you every step of the way to ensure that you "work your plan". Your plan is participatory and could include earning additional income and/or reducing discretionary expenses.

Periodic Review:

It's sometimes difficult to remain on track. "Life Happens" so circumstances and goals and objectives can change. Your plan should be reviewed periodically to account for these changes and also to assess the performance of previously established investment accounts.